.jpeg)

SILVER IS STEALING THE SPOTLIGHT – GOLD, ARE YOU WATCHING?

For years, gold has been the unquestioned star of the precious metals performance space. Whenever uncertainty rises, gold commands attention, headlines, and investor confidence. But markets have a way of quietly shifting focus. And lately, that focus has been drifting – not loudly, not dramatically – but clearly.

Silver is stealing the spotlight.

Recent market performance shows silver moving ahead of gold, surprising many who still view it as gold’s quieter cousin. This shift is not accidental, and it’s not hype-driven. It’s rooted in how the current market environment is evolving.

Let’s break down what’s happening – calmly, factually, and without exaggeration.

SILVER VS GOLD: A QUICK PERFORMANCE CHECK

In recent weeks, silver prices have shown stronger momentum compared to gold. While gold has largely remained stable, silver has recorded sharper upward movements, reflecting higher trading volumes and MCX silver analysis insights.

This divergence is important. When two assets from the same category behave differently, markets are sending a signal – not about weakness, but about changing priorities.

Gold is doing what it does best: holding ground.

Silver, meanwhile, is responding to a different set of forces.

WHAT’S DRIVING SILVER’S MOMENTUM RIGHT NOW?

Silver is unique because it plays two roles at the same time.

Unlike gold, which is primarily a store of value, silver has a strong industrial identity. A large portion of global silver Industrial demand comes from industries such as:

• Solar panel manufacturing

• Electric vehicles and batteries

• Electronics and semiconductors

• Medical and chemical applications

As global manufacturing activity stabilises and clean energy initiatives continue, silver demand naturally strengthens. Markets are factoring this in.

In simple terms:

When economic activity picks up, silver often responds faster than gold.

That’s exactly what current price action reflects.

WHY GOLD ISN’T WEAK – IT’S JUST PLAYING DEFENCE

It’s important to be clear here: gold is not underperforming because it is failing. Gold is behaving exactly as expected in a market that is neither in panic nor in extreme uncertainty.

Gold typically shines brightest when:

• Inflation risks surge

• Currency instability rises

• Geopolitical stress escalates sharply

In calmer or moderately optimistic environments, gold tends to consolidate rather than rally aggressively. This phase of steadiness is not a flaw – it’s gold doing its job as a stabiliser.

Silver, on the other hand, thrives when markets begin to look ahead.

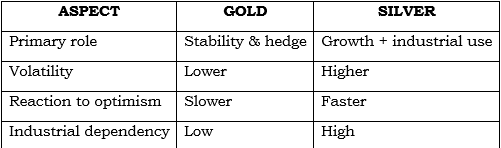

Same Asset Class, Very Different Behaviour

Although gold and silver are both precious metals, they respond differently to market moods.

This difference explains why silver often moves more quickly – both upward and downward. It captures opportunity faster, but it also demands greater awareness of risk.

WHAT THIS SHIFT SAYS ABOUT MARKET SENTIMENT

When silver begins to outperform gold, markets are usually signalling:

• Improved risk appetite

• Focus on industrial growth

• Forward-looking optimism rather than fear

This doesn’t mean uncertainty has disappeared. It simply means markets are balancing caution with opportunity – and silver fits that narrative well.

Such phases are common in commodity cycles and are closely watched by participants who track inter-commodity behaviour rather than isolated price movements.

WHY WATCHING BOTH METALS MATTERS

One common mistake is treating gold and silver as interchangeable. They are not.

Tracking both helps in:

• Understanding shifts in market sentiment

• Identifying phases of expansion vs protection

• Avoiding one-dimensional commodity exposure

Silver’s current momentum does not replace gold’s relevance. Instead, it complements it. Together, they provide a clearer picture of how the commodity landscape is evolving.

THE BIGGER PICTURE: ATTENTION IN MARKETS IS CYCLICAL

Markets don’t move in straight lines – and neither does attention. Today, silver is in focus. Tomorrow, conditions may once again tilt in favour of gold.

What matters is not prediction, but awareness.

Understanding why leadership changes within the same asset class is what separates informed market participants from reactive ones.

A CALM TAKEAWAY

Silver’s recent outperformance is not a headline gimmick. It’s a reflection of real demand dynamics and shifting market expectations. Gold remains relevant, steady, and essential – just operating in a different role for now.

Staying informed about such shifts helps investors and traders read markets better, without rushing into conclusions.

At GoPocket, we believe clarity and context matter more than noise. Keeping an eye on how commodities behave – not just where prices move – builds better market understanding over time.

"Investments in securities market are subject to market risks. Read all the related documents carefully before investing."

What's Trending

January 23, 2026

September 30, 2025

Recent Blog

Open Your Demat Account in Under 5 Minutes

Have any queries? Get support

Blog

Recent Blogs

Open your GoPocket Account within 5 minutes.

Have any queries?

.jpeg)

.jpeg)