“Have you already heard about this F&O stuff but getting confusions while you try?”

You’re not alone.

Futures & Options (aka F&O) is one of those parts of the stock market that sounds complex at first — and maybe even risky. But here’s the truth: if understood well, F&O can be a smart tool for investors, especially those who want more than just long-term gains. Whether you’re a salaried professional, student, side-hustler, or active trader — you deserve to know what this buzzword is really about.

Let’s decode it all in simple terms.

First of all, what exactly is F&O trading?

Let’s break it down like we’re explaining it to a friend.

FUTURES

Futures are contracts to buy or sell something at a specific price on a future date.

Let’s say you think a stock will go up next month. With a futures contract, you basically fix today’s price for a stock you’ll buy or sell later. So, if the price goes up by then, that difference becomes your profit

If it goes down? You’ll bear the loss.

Simple.

OPTIONS

Options are similar to futures — but with a twist: you get the “option” to buy/sell, not the obligation.

You just put in a small amount first — kind of like a booking fee — and take a position on where you think the market is headed. If the stock moves the way you expected — great! You make a profit.

If not? You can walk away, and your loss is limited to the small premium you paid.

WHY DO PEOPLE EVEN TRADE IN F&O?

Because sometimes, “just holding” a stock isn’t enough.

F&O is where smart money strategies happen. People use it for:

• Hedging: To protect their portfolio from losses

• Speculating: To earn short-term gains

• Leveraging: To trade bigger using less capital

• Earning in volatile markets: Even if the market goes down

You don’t need crores. You just need clarity.

So, is F&O only for advanced traders?

That’s what people assume. But times are changing.

Today, with platforms like GoPocket simplifying access to stock markets, even beginner investors are entering F&O segments — slowly and smartly.

Here’s what makes F&O attractive for today’s new-age investors:

• You can trade in both circumstances - either when market is up or down

• It trains you to think tactically about the market

• You don’t need full capital to get exposure — margin trading exists

• You can trade in a wide range of indices, sectors, and stocks

It’s not just about fast money. It’s about flexible strategies that suit different life goals.

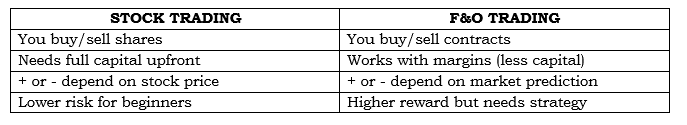

HOW IS F&O DIFFERENT FROM REGULAR STOCK TRADING?

That’s why it helps to begin with a calm mindset, clear goals, and the right support — not just pure excitement.

A QUICK STORY YOU’LL RELATE TO

Dhyan, (in his late 30’s) – a marketing executive, wanted to try more than SIPs and mutual funds.

He didn’t want to gamble — he wanted to learn.

He opened a Demat account, attended live F&O webinars through GoPocket, and began trading small with Options. Over time, he built confidence. That wasn’t always a win – but he learnt

F&O didn’t make him a millionaire overnight.

But it made him a smarter investor.

What are the risks in F&O? (Let’s not sugar-coat)

• There are Potential for high returns but Possibility of high losses are also there

• F&O allows to play smart, but if you stay not knowing the rules, it may seem much confused

That’s why knowledge + tools = safety.

The right platform won’t just show charts — it’ll also help you understand what they mean.

(Hint: GoPocket does.)

SO, SHOULD YOU TRY F&O?

Here’s how to decide: Ask yourself

• Are you financially stable?

• Have you spent time learning the basics?

• Are you open to risks — but calculated ones?

• Do you want short-term trading exposure?

If you nodded “yes” to most of these, then maybe it’s your sign to start exploring.

Not with big bets. Just with better awareness.

A few tips before you start F&O trading

• Learn before you earn

• Use stop-loss to manage risks

• Stick to a trading plan

• Talk to experts (GoPocket’s dealing desk helps)

• Track market news and expiry dates

FINAL WORD

The stock market isn’t just about long-term investing anymore.

Beginners must-haves are control speed and smarter strategies - and that's where F&O pops in

You don’t need to dive deep all at once.

Once you get the hang of F&O, you’ll be thinking ahead while others are still catching up.”

And when you’re ready, open a GoPocket Demat account and explore these strategies — safely, simply, and smartly.

"Investments in securities market are subject to market risks. Read all the related documents carefully before investing."

What's Trending

September 13, 2025

September 16, 2025

February 27, 2026

Recent Blog

Open Your Demat Account in Under 5 Minutes

Have any queries? Get support

Blog

Recent Blogs

Open your GoPocket Account within 5 minutes.

Have any queries?

.jpeg)

.jpeg)